Between 2007 and 2016, the average wealth of the bottom 99% decreased by $4,500. This decline was particularly

concentrated among the housing wealth of AfricanAmericans. Outside of home equity, black wealth recovered its 2007 level by 2016. But average black home equity was still $16,700 less. Meanwhile, over the same period, the average wealth of the top 1% increased by $4.9 million. Much of this decline in wealth, we argue, was the direct result of policies enacted by President Obama. His housing policies, particularly regarding foreclosures, were a disastrous failure that led to millions of families losing their homes, with black families suffering especially harsh losses. What’s more, Obama had power—money, legislative tools, and legal leverage—that could have very sharply ameliorated the foreclosure crisis, if not largely prevented it. He chose not to use them.In the following essay, we shall examine the circumstances that led to the housing bubble, and its eventual collapse in Part I. In Part II, we shall take a close statistical look at the decline in black housing wealth. And in Part III, we shall outline an approach that would have halted the foreclosure crisis, had President Obama chosen to pursue it.

Tag Archives: Housing Bubble

The largest transfer of wealth in living memory

Housing is a human right not a commodity

In Melbourne, Australia, one in five investor-owned units lie empty, the report says; in Kensington, London, a prime location for rich investors, numbers of vacant homes rose by 40% between 2013 and 2014 alone. “In such markets the value of housing is no longer based on its social use,” the report says. “The housing is as valuable whether it is vacant or occupied, lived in or devoid of life. Homes sit empty while homeless populations burgeon.” …

Farha, 48, by background a human rights lawyer and anti-poverty activist, calls for a “paradigm shift” whereby housing is “once again seen as a human right rather than a commodity”. It is clear, she suggests, that the UN’s sustainable development goal of ensuring adequate housing for all by 2030 is not only receding, but without regulatory intervention to re-establish the primacy of housing as a social good, laughably optimistic. Continue reading

The problems of the handling of the Great Recession by Democrats

That’s how the party ended up with its most vulnerable members — centrist Blue Dogs in the South — hawking austerity during the worst mass unemployment crisis in 80 years. Almost all of them lost in 2010. That loss, in turn, paved the way for many of the other major problems Democrats are having. That was a census year, and huge Republican victories allowed them to control the subsequent redistricting process, in which they gerrymandered themselves a 7-point handicap in the House of Representatives and in many state legislatures.

That brings me to the foreclosure crisis, the handling of which was even worse. Instead of partially ameliorating it as with employment, the Obama administration helped it happen. As David Dayen writes in Chain of Title, the financial products underpinning the subprime mortgage boom were riddled with errors, and in order to be able to foreclose on people who had defaulted, they had to commit systematic document fraud. This epic crime spree gave the White House tremendous leverage to negotiate a settlement to keep people in their homes, but instead the administration co-opted a lawsuit from state attorneys general and turned it into a slap on the wrist that reinvigorated the foreclosure machine. There was also $75 billion in the Recovery Act to arrest foreclosures, but the administration’s effort at this, HAMP, was such a complete disaster that they only spent about 16 percent of the money and enabled thousands of foreclosures in the process.

Continue reading

Housing Bubble: 3 factors that determines the rent prices

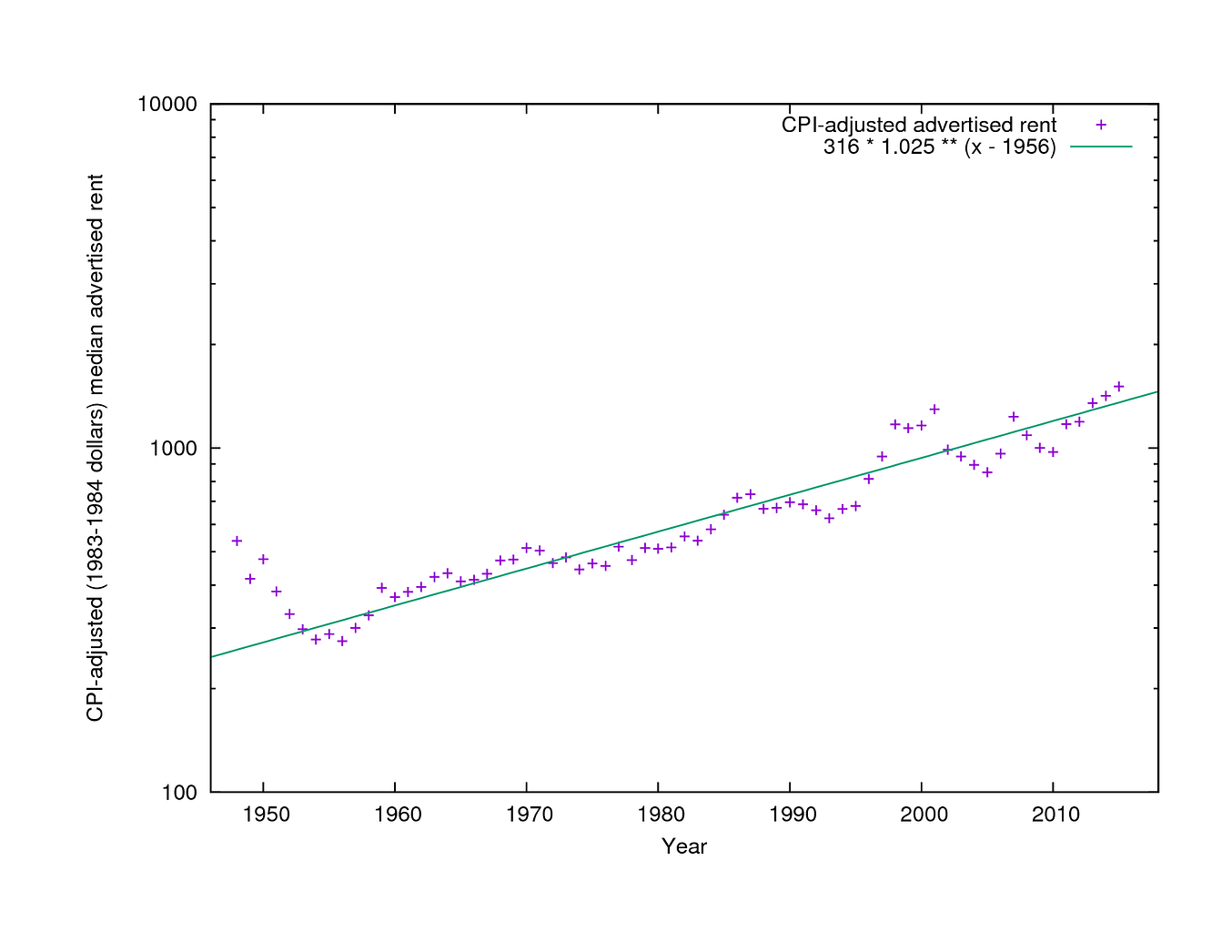

Instead of getting any further into that, this blog post exists to re-emphasize what his new data revealed: this chart

That, my friends, is 70 years of San Francisco housing prices. There are some ups and downs, but for the most part there is a very simple trend: 6.6 percent.

That’s the amount the rent has gone up every year, on average, since 1956. It was true before rent control; it was true after rent control. It wasn’t entirely true during the 2000 tech bubble, but it was still sort of true and it became true again afterward.

6.6 percent is 2.5 percentage points faster than inflation, which doesn’t seem like a lot but when you do it for 60 years in a row it means housing pricesquadruple compared to everything else you have to buy.

That’s bad. But that’s SF today, compared to 1956.

So what caused prices to go up? That’s the really exciting part of Fischer’s discovery. Armed with his data, he more or less answered that question. Continue reading

The super-rich inevitably pops the housing bubble

The bigger the bubble, the longer the hangover.

But what would happen if they did actually go? As Danny Dorling, the Oxford professor of geography, notes, the ultra-moneyed classes do abandon cities – “at a time of their choosing”. Long Island was once so rich as to be the setting for the Great Gatsby – until the crash of 1929. Now the grand houses remain but the big-money holidays at the Hamptons. (For more data, look at Dorling’s new book A Better Politics, free online here.) The other thing we know is that cities that get too high on speculation face a long, long hangover.

Continue reading

The UK housing crisis

Austerity and the Housing Bubble

The reason for this that everyone focuses on, understandably, is stagnant housing supply. However, housing can also be seen as an asset. Just as low real interest rates boost the stock market because a given stream of expected future dividends looks more attractive, much the same is true of housing (where dividends become rents). Stock prices can rise because expected future profitability increases, but they can also rise because expected real interest rates fall. With housing increasingly used as an asset for the wealthy, or even as a way of saving for retirement, house prices will behave in a similar way. A shortage of housing supply relative to demand raises rents, but even if rents stayed the same falling expected real interest rates raise house prices because those rents become more valuable compared to the falling returns from alternative forms of wealth.

Continue reading

The Great Recession and the Housing Bubble

When the bubble burst housing construction fell back not just to its normal levels, but to its lowest share of GDP on record. The reason is that the construction from the bubble led to enormous overbuilding, which meant record high vacancy rates. The loss of $8 trillion in housing wealth led to an end of the bubble driven consumption boom. Taken together, the falloff in residential construction and the drop in consumption implied a loss in annual demand of more than 6 percentage points of GDP (@ $1.1 trillion in today’s economy).

There was no easy way to replace this loss in demand. Investment was not about to jump by 50 percent. Net exports could and did increase, but this is a slow process. In short, when the bubble burst we were destined to have a serious recession with or without the financial crisis.