The arms industry finds itself in the climate finance frame

‘At Bonn talks, G77 group floats a 5% sales tax on tech, fashion and defence firms to fund green spending in the Global South’

Climate Home News reported in the first days of the Bonn Climate Conference, the annual mid-year preparatory conference that precedes COP each year.

Early on in the conference the debate about how to fill the coffers of the new climate finance goal (NCQG) – in other words, how to move from billions to trillions (and fast) – was clearly taking priority. While rich nations (Annex II ) are obligated to pay for international climate finance under the Paris Agreement, they are now saying they are struggling to find the funds to do so and are calling on countries like China to step up also.

As a route to pushing this back, Saudi Arabia, endorsed by the Arab Group and G77+China offered a proposal whereby developed countries can raise $441 billion “without compromising spending on other priorities entirely by adopting targeted domestic measures” such as a “financial transaction tax”, a defence company tax, a fashion tax and a “Big Tech Monopoly Tax”.

‘Referring to the document in talks on the new finance goal yesterday, Saudi Arabia’s negotiator justified a tax on arms manufacturers by saying that military emissions of planet-heating gases represent 5% of global historical emissions. “One… potential idea is to have a tax on defence companies in developed countries,” he said, suggesting it could be put forward…. Around $21 billion a year could come from a 5% tax on the annual sales of the top 80 defense firms in developed countries, the paper says.’ Climate Home News

Credit: Climate Home News

Some eyebrows raised – was Gaza a reason?

A proposal on an arms industry tax from one of the world’s biggest arms buyers left some asking very obvious question: what’s this about?

Anabella Rosemberg and Tasneem Essop protest at the opening plenary (Photo: Kiara Worth/IISD ENB)

Anabella Rosemberg and Tasneem Essop protest at the opening plenary (Photo: Kiara Worth/IISD ENB)

It certainly raised eyebrows in some quarters. Why bother to include it alongside the much bigger industries of finance, tech and fashion? Supported by the Arab Group and G77+China, one can only wonder if the war on Gaza played some role in the inclusion of arms in this proposal. Gaza was ever present in many ways at Bonn.

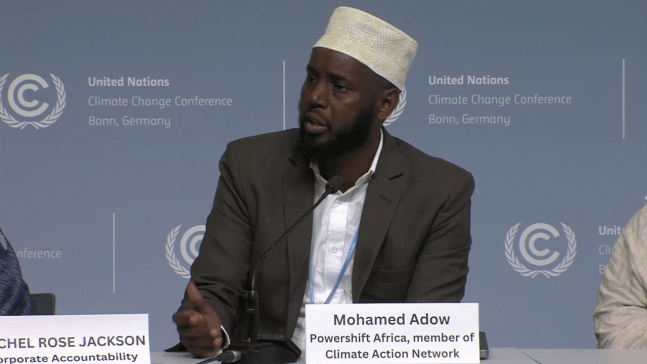

And Mohamed Adow, Director of Powershift Africa and a leading media spokesperson on climate and climate finance referenced military emissions and spending at a CAN Int’l press conference ‘ Defund the genocide.’

Inevitably the sales tax proposal was widely covered by the climate media with special interest in the arms sales tax component. There are questions that will need to be addressed concerning the arms industry aspect of the sales tax: after all, it’s not the public who procure arms as they do tech or fashion – it’s governments via defence budgets. So how will that work? The arms companies add it to the cost and the buying governments simply pay more?

However, there remains no way to avoid the elephant in this particular room: the oil-military-arms industry nexus. The latter are utterly dependent on the former and of course, oil has been a cause of war and instability decade in and decade out. The proposal also does not deflect from the hard truth that Saudi Arabia is in the hottest of hot seats in relation to the ‘make polluters pay’ demands by civil society.

The idea ‘is in the air’ and we support it

The timing of the Saudi /Arab Group/G77+China Sales Tax proposal chimed exactly with our report released for Bonn ‘Excess profits tax on the arms Industry to fund climate finance.’

The G77+China proposal clearly reinforces the in-principle value of such a call. It’s time has come.

We are watching its development closely while we continue to advocate an excess profits tax, not a sales tax and one that is universal, not just levied on rich world arms companies.

Taking these differences into account, the numbers in each proposal are not far from each other – the G77+China proposal and our Transform Defence proposal arrive at very similar revenues from taxing arms companies for funding climate finance.

And critically, our call for a global arms profiteering tax is not to call into question the Paris Agreement decision that only Annex 2 – highly developed countries – should pay for climate finance. They should. And in this sense, we applaud the inclusion of the arms industry in the G77+China proposal, directed at developed country arms industries. There must be no rule change. No more disingenuous delaying tactics to avoid paying up.

Big step forward

For all of us who work to get military emissions taken much more seriously and urgently addressed alongside the interlinked (and big) problem of runaway military spending and arms industry profiteering, this proposal by Saudi/Arab Group/G77+China is a huge step forward. Any effort – especially one led by states – that places the arms industry alongside other industries such as tech, finance and fashion in the climate finance frame – is of value to the wider debate.

Bolivian negotiator Diego Pacheco, who often speaks for the influential Like-Minded Developing Countries group, told Climate Home that

“The [argument of a] lack of public finance is not true,” he said. “There is a lot of finance available and political will is lacking.” He suggested that developed countries should shift military budgets towards tackling climate change or tax luxury products “because luxurious patterns of consumption are also a driver of the climate crisis”.

The climate justice movement wholeheartedly agrees.

The appetite is there

Since we attended our first COP at Sharm El Sheikh in November 2022 there has been a quantum shift in awareness concerning military emissions and it has been catapulted onto the UNFCCC agenda – primarily due to Russia’s invasion of Ukraine and Israel’s genocidal war on the Gazan population. This in turn has enabled some of us to connect the emissions narrative to another: runaway military spending, and the madness of ever rising investments in war while the greatest threat to human safety – climate chaos – is de-prioritised.

Our work has shown that the wealthiest countries (Annex II in the UN climate talks) are spending 30 times more on their militaries than on providing climate finance for the world’s most vulnerable countries.

This situation is becoming ever less tenable. From the UN Secretary General to calls by states at UNFCCC meetings, military spending vs climate finance is becoming an ever more present issue. In the call for the move from billons to trillions for climate finance, it is clear that the $2.4tr p/a spent on militaries is an ever more legitimate source to tap for climate finance. And within that, a tax on the close military spending bed-fellow: the arms industry polluters and profiteers.

This, coupled with the worldwide recognition that fair taxation is central to lifting all our societies up, from public services to climate finance, means that we are getting ever closer to putting both the arms industry and military spending in the climate finance frame.

The sooner the better.

*******

Notes

- TPNS’s Transform Defence project proposes an excess profits tax on the arms industry to be applied to fund climate finance needs. It estimates that a global excess profits tax on arms companies could deliver $30 billion dollars every year to fund international climate finance. In times of war, we estimate that an additional punitive excess profits tax on war profiteers could deliver considerably more. Had this war profiteers tax been applied in 2024 (for Ukraine and Gaza wars), an extra $52bn would have brought the 2024 annual total to $82 billion. This tax alone would be more than four fifths of the pledged (but never fully fulfilled) $100 billion a year climate finance by developed countries to developing countries

- Annex I Parties include the industrialized countries that were members of the OECD (Organisation for Economic Co-operation and Development) in 1992, plus countries with economies in transition (the EIT Parties), including the Russian Federation, the Baltic States, and several Central and Eastern European States. Annex II Parties consist of the OECD members of Annex I, but not the EIT Parties. They are required to provide financial resources to enable developing countries to undertake emissions reduction activities under the Convention and to help them adapt to adverse effects of climate change.